Driven “Enterprise” – Web, Mobile

UX Manager, Lead

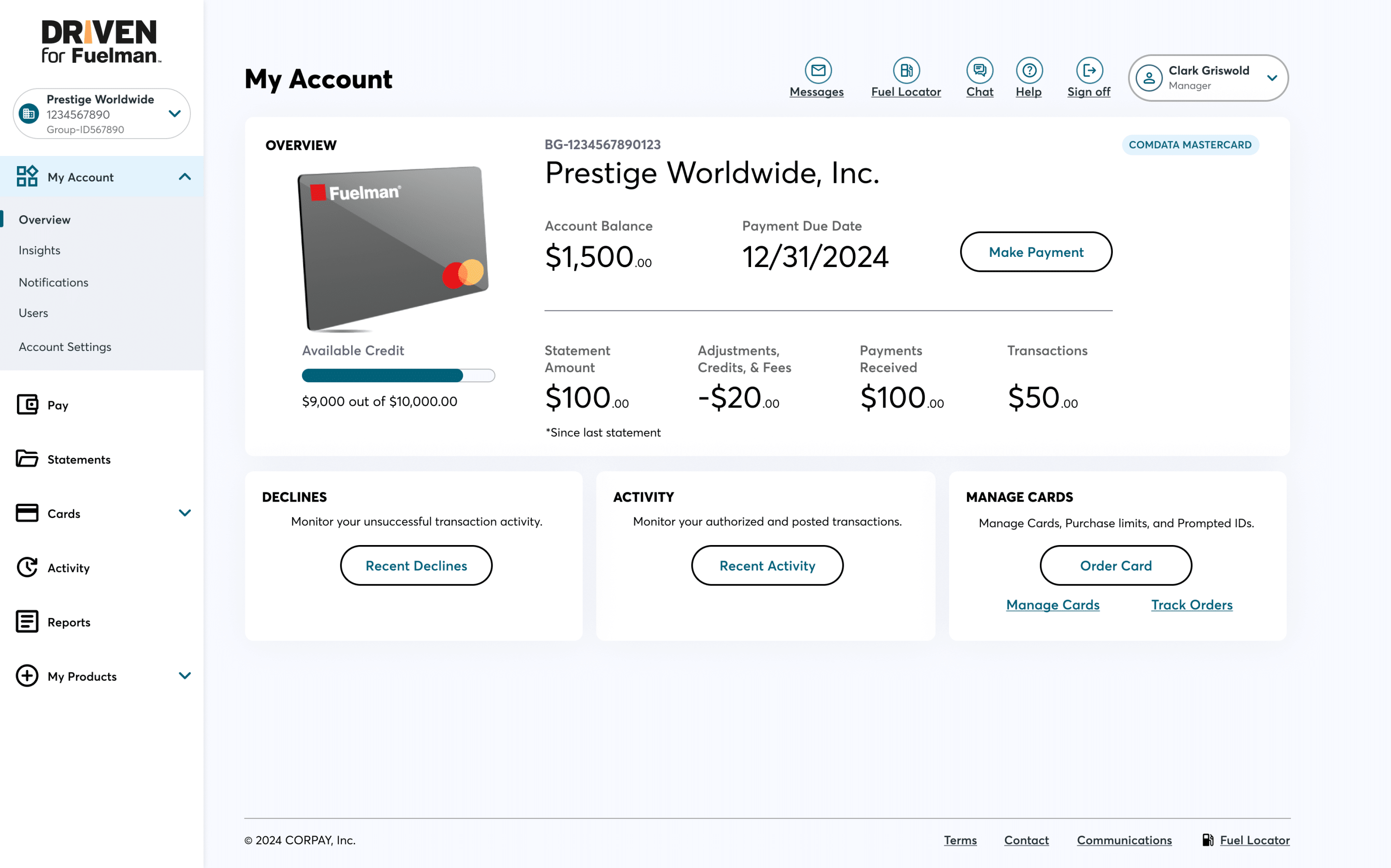

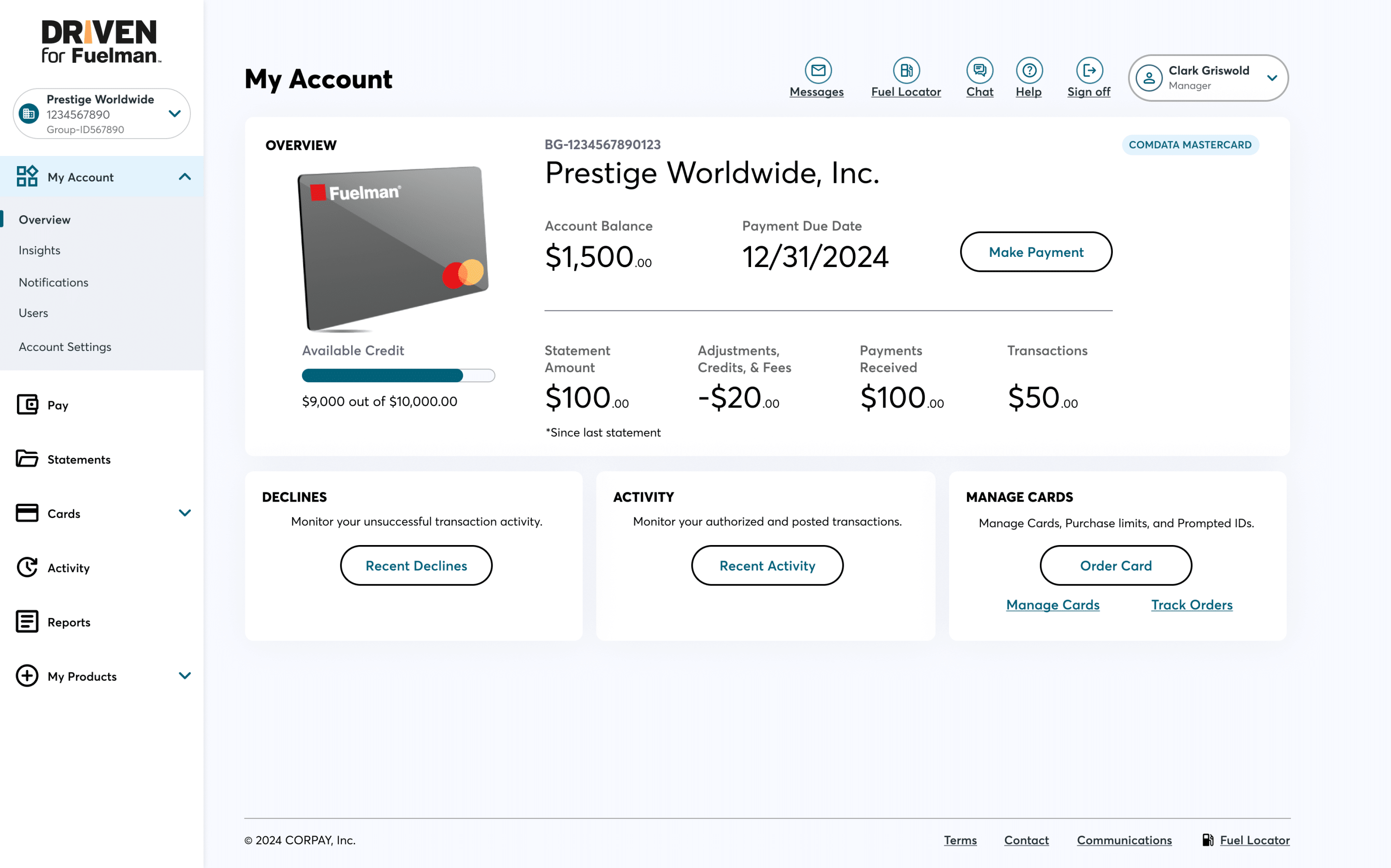

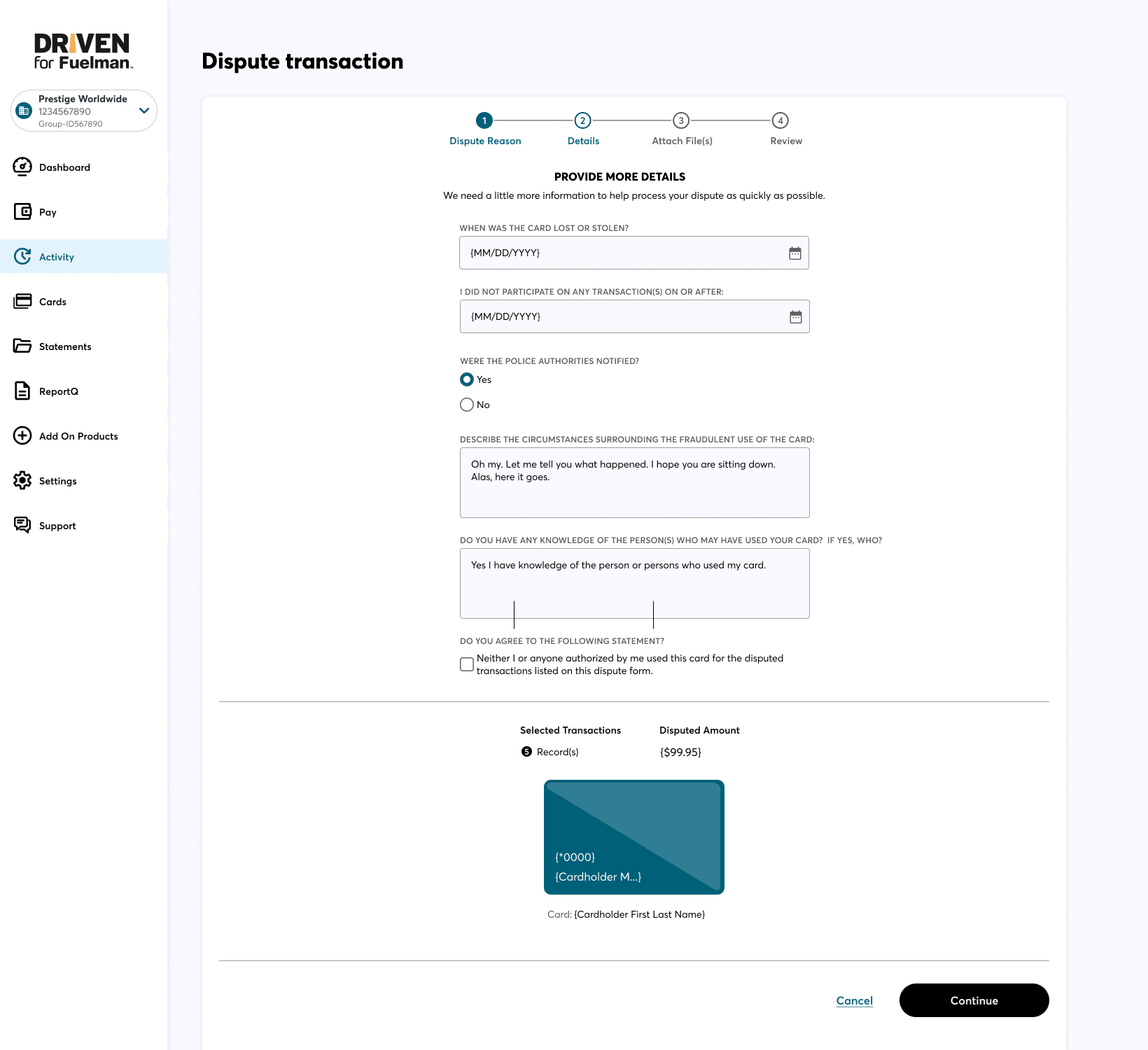

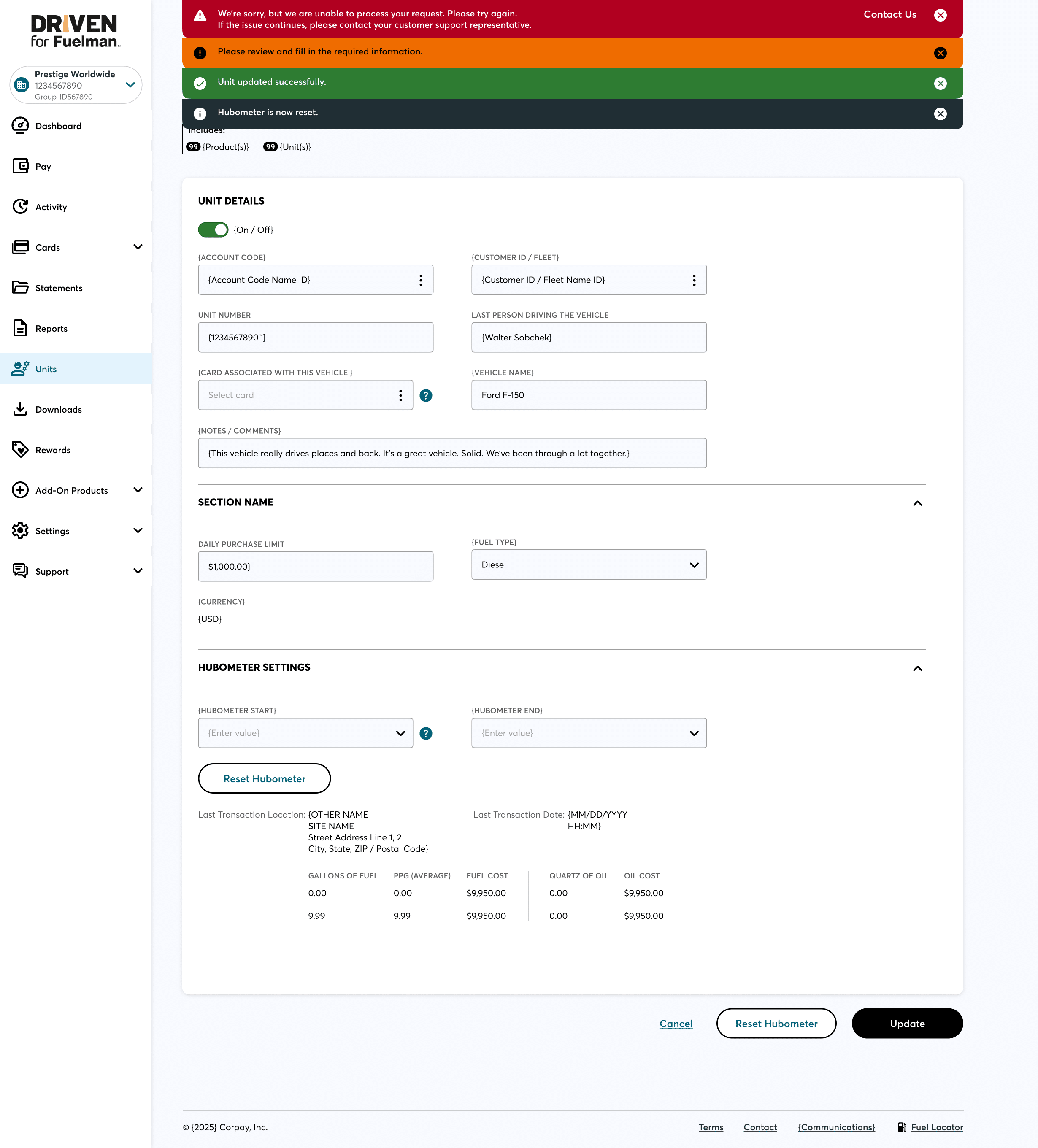

The Driven web app helps businesses manage expenses, cards, credit accounts, and bill payments, across many accounts. The Driven web offers many common banking tools, but many unique tools for businesses with many billable departments, users, and accounts. The “Small to Medium” version of Driven comes with a core functional set of financial and card management capabilities. The Driven app itself is also configurable for (10 – 15) other business partners, who receive customizations to the software to fit different business models. The number of acquistions and integrations changes +1 per year / average.

Typical Configuration:

Money Transactions * Cards * Purchase /Card Limits * PINs * Accounts * Departments * Vendors * Fleets / Customer Groups * Bill Pay * Reports * Users * Security

Users:

1,000 – 50,000

Administrators * Managers * Viewers * Accountants * Drivers / Employees

Devices:

Desktop, Tablet, Mobile

Group: North America – Fuels

Team:

- 1 – UX Consultant

- 14 – 22 Developers

- 6 – 9 QA

- 1 – 4 Product Owners

- 5 – 12 Stakeholders

Duration:

- Course of 1+ years

Challenges:

- How might an account manager of a large fleet get easier access to their huge chunks of data?

- How might an administrator be able to register / activate / upload huge numbers of users?

- How might an administrator prefer to use the Driven platform when they have:

- 1 – 10 accounts

- 11 – 25 accounts

- 26 – 50 accounts

- 50 – 100+ accounts

- How can we increase the performance of the top 5 pages, so that they load in < 2 seconds?

- Of all transaction data, what parts of the data are:

- Critical / most essential

- Important / nice to have

- Less important

- How can the app communicate more effectively, with select users tasks experiencing system delays in being updated?

- How can we increase the quality of coding/development published, so that we can reduce the reported UI bugs 30% or more for an average of 51 issues per month.

- What other valuable insights can we display, where can we display it, how can we display it, with the technical limits of:

- 20 or fewer customer groups at a time

- 2,000 or fewer transactions at a time

- 1,000 or fewer cards at a time.

- 1,000 or fewer purchase limits at a time.

- How might an account manager/driver user activate their account more quickly (< 30 days from credit check)?

- How might an account manager user more easily get the Card to the driver (< 48 hours from receipt of the Card)

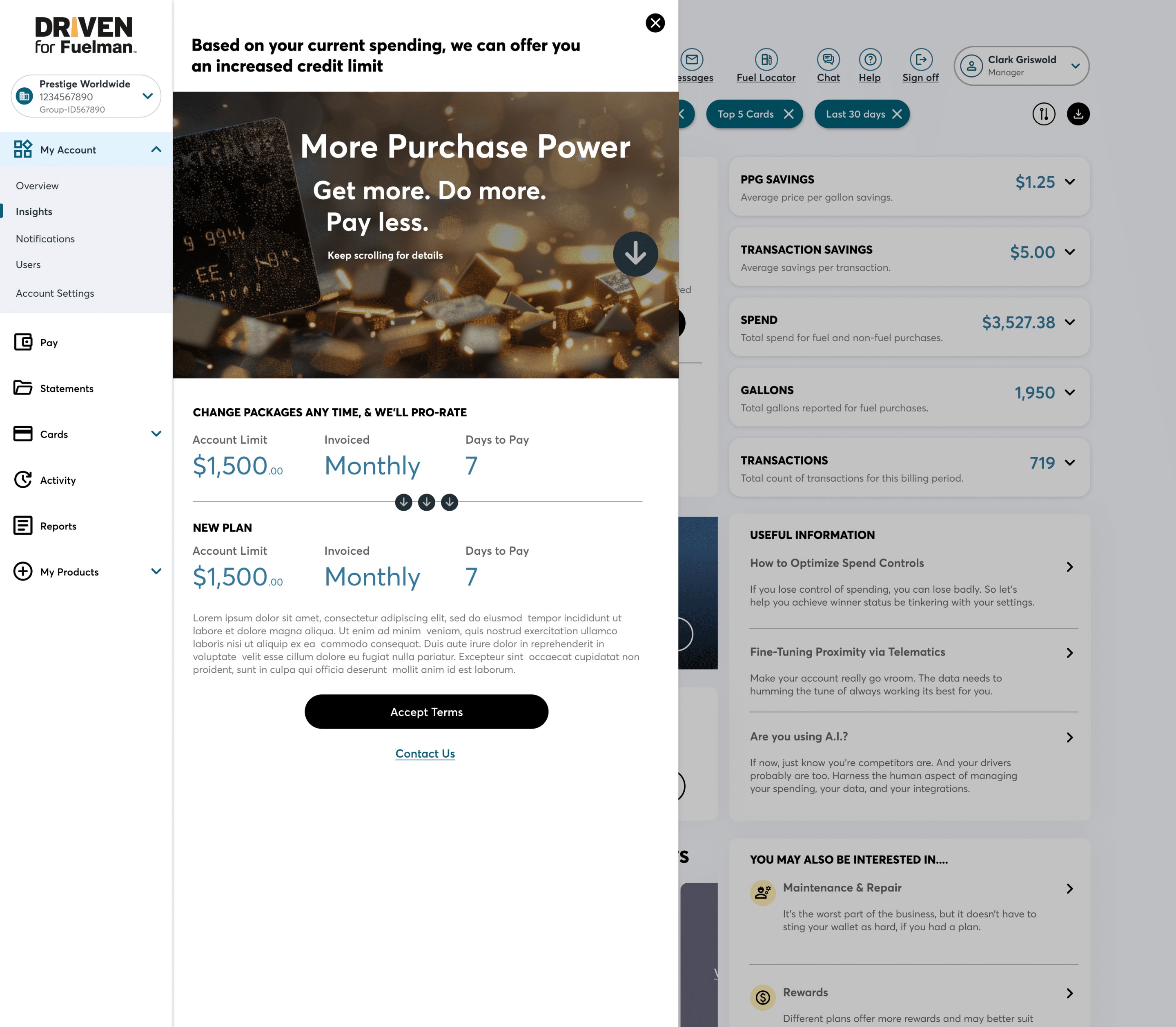

- How might a non-customer get pre-approved for more credit and more products?

- How might a user become more engaged with the app in ways that are not only paying a bill?

- How might a user be more aware of credit usage/upgrade opportunities?

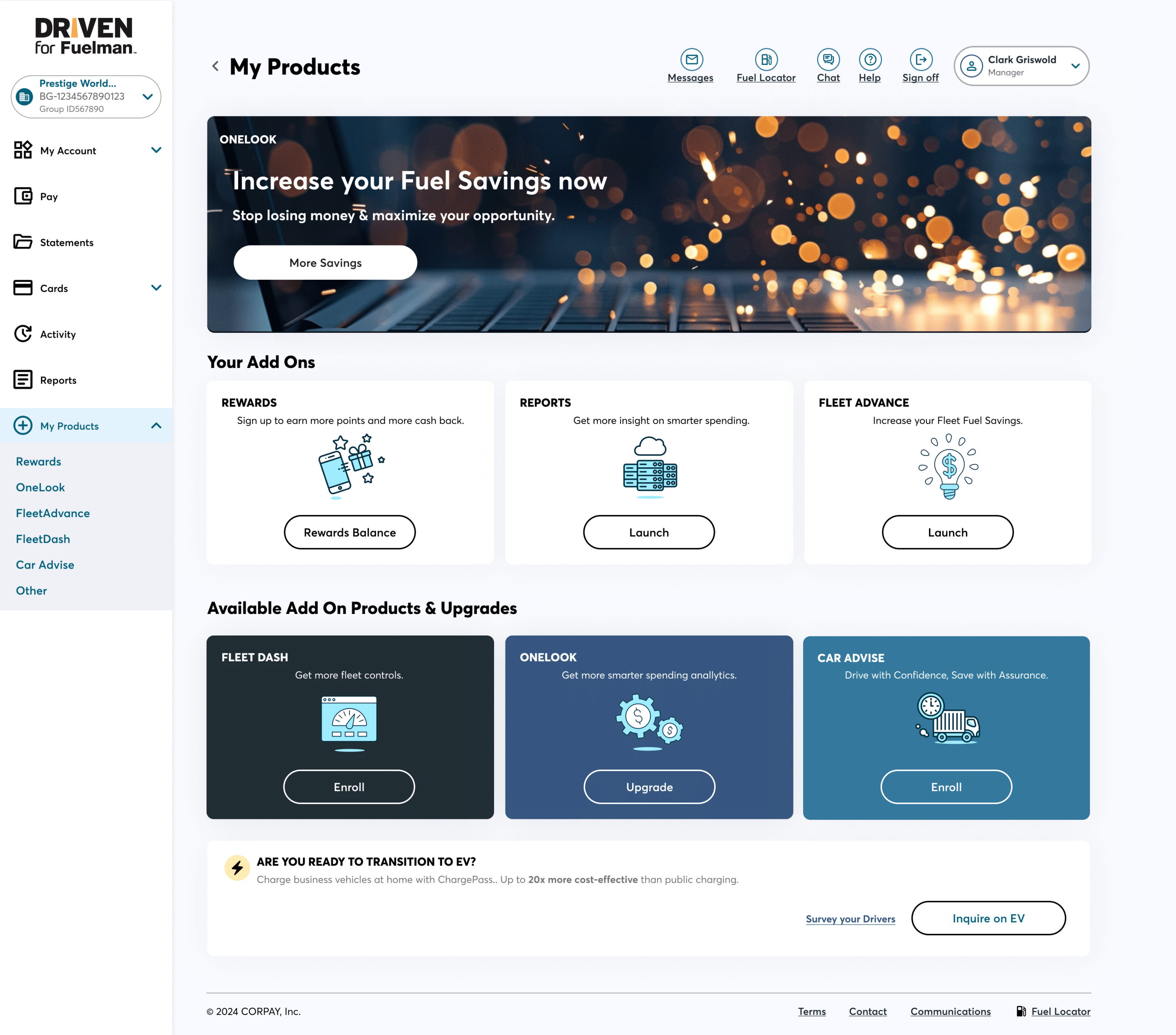

- How might an administrator be enabled to subscribe to more products?

- How might a driver be more successful in fixing issues at merchants and stores?

- How might a driver use their card more easily, while maintaining required levels of security (i.e. Card lock)?

- How might a driver be granted authorization to more cards (in the event of replace, transfer, cancel, new card) scenarios?

- How might a cardholder more securely verify their card / account / plan, without needing to call customer support or their administrator?

Deliverables:

- ~3,600 wireframes / year (created, maintained)

- ~125 flow diagrams (users, systems) / year

- 211 UI component library

- 60+ UX consultations / year

- 70+ pages of annotations / year

- Interview scripts with multiple paths

- Customer Support representatives

- Sales representatives

- Human analysis of data (raw data, system-generated data)

- Interactive prototypes

- Register / Sign Up / Account setup

- Account maintenance tasks

- Navigation / browsing / searching configurations

- Dashboard configurations

- Cross-selling configurations

My contributions:

- Team lead – 99%

- Design Library maintenance – 99%

- Reporting / Presentations – 30%

- Creating interactive prototypes – 99%

- Reviewing / approving designs – 90%

- Promoting / Selling UX services – 10% – 20%

- Content Writer – 50%

My team, contributed in other amounts, in other collaborative and useful ways. There were heavily more stakeholders on this project, relative to most projects. The executives were more interested and involved with this project, due to revenue potential and clients (Amazon). The team was made up of more developers and QA people, than most projects. The design team was focused on NAF projects only at this time, but had fewer designers stretched across more releases. I managed parts of the apps, within the Driven network of apps.

Measure:

- 12 Human Interviews

- Google, Adobe Target, Dynatrace, Splunk

- Multiple Sales, Customer support representative interviews

- Live product usage data

- Multiple UX team collaborations

Conditions:

- Various process changes, and different ways of working

- Limited budgets ($0 – $15,000 / annual)

- Major changes in senior leadership

- Sub-standard development team.

- Only 1 Front-end UI Developer

Results:

- Launched the enterprise version of Driven, that loaded in <3 sec (on average per page).

- Proceeded to make the setup / registration / verification process shorter and more streamlined in areas where internal company policies allowed.

- Increased level of security to protect users from more fraud, failures, and troubles.

- +10% – Increased Card self-authorizations by customers between 2023 – 2024 – Driven network

- -7% – Reduced customer support call volume through self-service enhancements – Driven network

- +1.2 – Increase in visits per user, per month (from 1.5 to 2.7 visits) 2021 – Driven network

- ~38%+ – Increase in user count up to (from ~250,000 to ~650,000 users) 2024 – Driven Network

Contact me for a demo.

UX Manager, Lead

The Driven web app helps businesses manage expenses, cards, credit accounts, and bill payments, across many accounts. The Driven web offers many common banking tools, but many unique tools for businesses with many billable departments, users, and accounts. The “Small to Medium” version of Driven comes with a core functional set of financial and card management capabilities. The Driven app itself is also configurable for (10 – 15) other business partners, who receive customizations to the software to fit different business models. The number of acquistions and integrations changes +1 per year / average.

Typical Configuration:

Money Transactions * Cards * Purchase /Card Limits * PINs * Accounts * Departments * Vendors * Fleets / Customer Groups * Bill Pay * Reports * Users * Security

Users:

1,000 – 50,000

Administrators * Managers * Viewers * Accountants * Drivers / Employees

Devices:

Desktop, Tablet, Mobile

Group: North America – Fuels

Team:

- 1 – UX Consultant

- 14 – 22 Developers

- 6 – 9 QA

- 1 – 4 Product Owners

- 5 – 12 Stakeholders

Duration:

- Course of 1+ years

Challenges:

- How might an account manager of a large fleet get easier access to their huge chunks of data?

- How might an administrator be able to register / activate / upload huge numbers of users?

- How might an administrator prefer to use the Driven platform when they have:

- 1 – 10 accounts

- 11 – 25 accounts

- 26 – 50 accounts

- 50 – 100+ accounts

- How can we increase the performance of the top 5 pages, so that they load in < 2 seconds?

- Of all transaction data, what parts of the data are:

- Critical / most essential

- Important / nice to have

- Less important

- How can the app communicate more effectively, with select users tasks experiencing system delays in being updated?

- How can we increase the quality of coding/development published, so that we can reduce the reported UI bugs 30% or more for an average of 51 issues per month.

- What other valuable insights can we display, where can we display it, how can we display it, with the technical limits of:

- 20 or fewer customer groups at a time

- 2,000 or fewer transactions at a time

- 1,000 or fewer cards at a time.

- 1,000 or fewer purchase limits at a time.

- How might an account manager/driver user activate their account more quickly (< 30 days from credit check)?

- How might an account manager user more easily get the Card to the driver (< 48 hours from receipt of the Card)

- How might a non-customer get pre-approved for more credit and more products?

- How might a user become more engaged with the app in ways that are not only paying a bill?

- How might a user be more aware of credit usage/upgrade opportunities?

- How might an administrator be enabled to subscribe to more products?

- How might a driver be more successful in fixing issues at merchants and stores?

- How might a driver use their card more easily, while maintaining required levels of security (i.e. Card lock)?

- How might a driver be granted authorization to more cards (in the event of replace, transfer, cancel, new card) scenarios?

- How might a cardholder more securely verify their card / account / plan, without needing to call customer support or their administrator?

Deliverables:

- ~3,600 wireframes / year (created, maintained)

- ~125 flow diagrams (users, systems) / year

- 211 UI component library

- 60+ UX consultations / year

- 70+ pages of annotations / year

- Interview scripts with multiple paths

- Customer Support representatives

- Sales representatives

- Human analysis of data (raw data, system-generated data)

- Interactive prototypes

- Register / Sign Up / Account setup

- Account maintenance tasks

- Navigation / browsing / searching configurations

- Dashboard configurations

- Cross-selling configurations

My contributions:

- Team lead – 99%

- Design Library maintenance – 99%

- Reporting / Presentations – 30%

- Creating interactive prototypes – 99%

- Reviewing / approving designs – 90%

- Promoting / Selling UX services – 10% – 20%

- Content Writer – 50%

My team, contributed in other amounts, in other collaborative and useful ways. There were heavily more stakeholders on this project, relative to most projects. The executives were more interested and involved with this project, due to revenue potential and clients (Amazon). The team was made up of more developers and QA people, than most projects. The design team was focused on NAF projects only at this time, but had fewer designers stretched across more releases. I managed parts of the apps, within the Driven network of apps.

Measure:

- 12 Human Interviews

- Google, Adobe Target, Dynatrace, Splunk

- Multiple Sales, Customer support representative interviews

- Live product usage data

- Multiple UX team collaborations

Conditions:

- Various process changes, and different ways of working

- Limited budgets ($0 – $15,000 / annual)

- Major changes in senior leadership

- Sub-standard development team.

- Only 1 Front-end UI Developer

Results:

- Launched the enterprise version of Driven, that loaded in <3 sec (on average per page).

- Proceeded to make the setup / registration / verification process shorter and more streamlined in areas where internal company policies allowed.

- Increased level of security to protect users from more fraud, failures, and troubles.

- +10% – Increased Card self-authorizations by customers between 2023 – 2024 – Driven network

- -7% – Reduced customer support call volume through self-service enhancements – Driven network

- +1.2 – Increase in visits per user, per month (from 1.5 to 2.7 visits) 2021 – Driven network

- ~38%+ – Increase in user count up to (from ~250,000 to ~650,000 users) 2024 – Driven Network

Contact me for a demo.